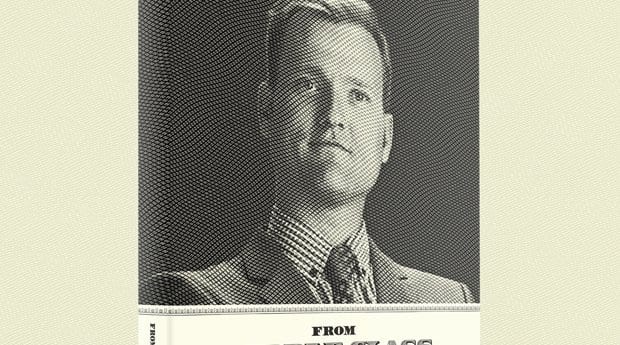

“Sex and money are so tied to each other,” David Campbell Lester says. Author of the bestselling investing book I Heart Money, Lester has written a follow-up book, From Middle Class to Millionaire, and he includes a section titled “Money and Relationship Contracts.”

“When I do the sex contract with couples,” he says, “I see a huge increase in money and nom noms [sex] that create positive feelings from both successes and allows the couple to move forward to achieve more of their own financial and personal goals. My experience is that sex and money are even more closely tied than people expect. There is a waterfall effect that when money is flowing, other things flow, too.”

He says he’s done this with a “ton” of gay and lesbian couples and it’s “always fun to see what people truly want in life and their partner has no idea what that is. People sleep beside each other night after night, and a life goal like having a cottage or spending a summer in Paris is a big surprise to the other partner when you draw it out of them. Understanding your partner’s goals and fantasies are key to understanding and properly communicating with them.”

It’s just one of the ways he incorporates his personal banking experience with his life-coaching training, to truly help people make the financial changes they need to have the lives they want. It’s not only in dollars and cents, but in life satisfaction, with an emphasis on economic optimism.

The beginning of From Middle Class to Millionaire reads a bit like a manifesto, pointing out that since the 1990s only the top fifth of Canadian earners increased their income in a significant way and that fewer people today think they will fare better economically than their parents did.

“The middle class is under a ton of pressure,” he says. “Middle-class incomes have been barely rising, but everything else continues to get more and more expensive. The average Canadian after-tax family income is around $80,000, roughly the same as 10 years ago. But the average Canadian home has rocketed up to almost $500,000. Soon the average home will be too expensive for the average family, and owning a home has been a cornerstone of middle-class wealth.”

He makes compelling arguments for what the government can do to improve pensions and retirement savings plans, but the real meat of the book is in what individuals can do for themselves. He points out that “80 percent of market managers underperform the market” and gives his approach on how to use RRSPs, RESPs and tax-free savings accounts to their maximum benefits.

As a life coach, he’s a big believer in living your best life now, rather than deferring all the things you want to do until retirement while working at a job that may be grinding you down. As he writes in the book, to turn things around, “you just need hope and a crappy day. One final crappy day pushed me over the edge.”

“I worked in a trendy industry for a long time that didn’t make my heart go thump,” he says. “It is a lot of work to figure out what you really want to do and then have the gumption to get out there and do it. It’s easy to be stuck in a gay-perfect career that is impressive to our friends and family but makes you want to be run over by the streetcar you’re riding to work every morning. Letting go of our egos in order to do what we love is a big leap. But when we figure it out, it is daily satisfaction that is eternal versus being a quick hit when you flash your business card.”

The latter parts of the book focus on this element, using exercises to help you determine what your values are, how you can go about building a career that satisfies those values and smart ways to make the transition without throwing yourself into economic uncertainty.

He’s also big on giving back and is a fan of kiva.org, “a non-profit organization with a mission to connect people through lending to alleviate poverty.” It’s pro-LGBT, though it faces challenges when providing loans in developing nations that are behind on LGBT rights.

“Making sure that you are taking some of your financial rewards and giving back to our greater world is great for our money mojo,” Lester says. “My example was kiva.org, but as long as you take a chunk of your income — making sure you can afford it — and giving back to our or other communities makes our world a better place. We are all one huge community, and we can’t forget to be grateful for our money success.”

Middle Class to Millionaire is available on indigo.ca.

Why you can trust Xtra

Why you can trust Xtra