When PrideVision TV recently fired their two programmers in favour of a US consultant, reduced staff from about 25 people to nine and cancelled most of its original programming, subscribers and industry analysts were left wondering about the health of the world’s first queer TV network.

Is PrideVision, which was launched by parent Headline Media Group last fall, trying to position itself for a buyout? Is it, as execs have claimed, being streamlined to make its offerings more “universal” (read: less Canadian) before attempting a US launch?

The idea of a gay specialty channel is one that many industry voices say is sound. So why does the channel’s hold on life seem so precarious?

Having lost $2.2-million against revenues of just $400,000 – half in monthly fees from about 22,000 subscribers and half in advertising revenue – in the quarter ending in May, PrideVision, like most of the other digital specialty channels, is bleeding cash.

Hugh Dow, president of Toronto-based media-buying firm M2 Universal, says that just a few good programs can make the difference between profit and loss.

“If there are a couple of flagship [shows] that attract media interest, create buzz and draw a faithful audience, they can provide momentum for the channel.”

Like the other specialties, PrideVision is taking stern measures to control costs.

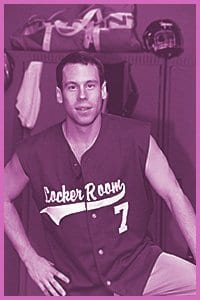

PrideVision has cancelled its own flagship news show, Shout, as well as three original independently produced shows: the call-in show Under Covers, Derek Noble’s Urban Fitness and the travel show Bump (co-produced by Xtra’s publisher, Pink Triangle Press). The sole survivor is the sports comedy show Locker Room for an undisclosed number of episodes. The only new original show this season is Jawbreaker, a talk show hosted by playwright Brad Fraser.

“We still have great series,” says Anna McCusker, PrideVision’s vice-president of marketing. McCusker directed questions about PrideVision’s future to David Errington, senior vice-president and general manager, who was not available for comment before Xtra went to press.

Mario Mota, publisher and editor of Ottawa-based Decima Publishing, calls the cost-cutting a Catch-22 situation.

“All providers are cutting programming to save money,” says Mota. “In turn, media buyers are telling them that their programming is not good enough, which drives away advertisers.”

Mota says it’s a matter of building a niche and a program base, which PrideVision can pull off, despite a rough start.

“They’re among the better supported specialties. They’ve positioned themselves as a premium service – like a pay TV channel – and seem happy there.”

But Duncan Hood, associate editor of industry-watcher Strategy Magazine, wonders if Headline Media Group has deep enough pockets.

“The cost of producing new programming and running a station for three to five years without significant return is enormous, probably more expensive than they anticipated,” says Hood.

Most larger digital owners like Alliance Atlantis, CHUMCity and Corus have built losses into their business plans and are able to last much longer than independents, says Hood. Headline Media Group doesn’t have that kind of bench strength.

So who would rescue PrideVision?

The most obvious choices might be CHUMCity or Alliance Atlantis, which both sought the must-carry digital licence from the Canadian Radio-Television And Telecommunications Commission. (Both CHUMCity and Alliance Atlantis declined to comment for this story.)

Hood says such a sale would be unlikely unless PrideVision is out of money.

“Right now it’s not a profitable business. The licence itself is worth something, and the CRTC is unlikely to grant another one. It’s possible that a CHUM or an AAC could see the long term potential to make money, and buy them just to get the licence.”

Mota points out, however, that Headline Media owner John Levy has a record of building up businesses and selling them.

“He built up his [Hamilton-based] cable company, CableWorks, and sold at the top of the market. He’s done the same with some of his specialty channels. It wouldn’t surprise me if similar plans are in the works.”

Todd Evans, president of Rivendell Marketing, a gay-specific media company based in New Jersey, adds a different perspective.

“One of my employees who came from [a US service that provides gay-oriented programming though cable] C1 heard that PrideVision was going to buy them out,” says Evans. “The notion they may be shopping themselves would be a surprise.”

Evans could only suggest Showtime as a possible US buyer, but thinks that unlikely. Entering the US market will be an uphill battle.

“They’re going up against Viacom [owner of MTV, which plans to launch a gay channel]. It’s like competing with the New York Times in print.”

With the departure of so many staff, there are few gay employees left at PrideVision. Is it important that a gay and lesbian station be run by gay people?

Florence Ng, director of broadcast services at media buyer Optimedia Canada, thinks it is.

“I don’t think gay or straight makes a difference in the sales department, but it does in programming. Having people who know their area is much more important there – it’s critical,” says Ng.

Evans disagrees: “If you’ve done your homework, gay or straight, you should be able to program effectively for a gay audience. That’s what focus groups are all about: Find out what your audience wants.”

Why you can trust Xtra

Why you can trust Xtra